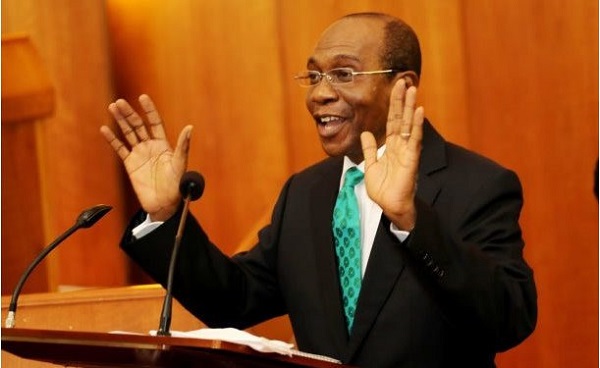

“Government’s printing of Naira simply means loans advanced to states to pay salaries and survive; and not the literal interpretation of printing money from the factory and sharing to the public,” according to Godwin Emefiele, Governor of the Central Bank of Nigeria. It was Emefiele’s initial reaction to a recent comment by Governor Godwin Obaseki of Edo State that the CBN printed about N60 billion to augment the Federal Account Allocation Committee subvention to states in March.

Speaking at the Edo State Transition Committee stakeholders Engagement, Obaseki had raised concern that the step the apex bank took was an indication that the Nigerian economy was ailing.

The Edo State Governor said: “When we got FAAC for March, the Federal Government printed additional N50 billion to N60 billion to top-up for us to share. This April, we will go to Abuja and share. By the end of this year, our total borrowings are going to be within N15 trillion to N16 trillion.” This position by Obaseki elicited varied reactions from cross sections of Nigerians, most of it creating panic.

However, the National Economic Council has affirmed that there was no printing of N60 billion or any other amount to shore up allocation for the month of March. The council, which is chaired by Vice President Yemi Osinbajo, took the position during its meeting in Abuja on Thursday. A statement by Laolu Akande, spokesperson for the Vice President, said the Council expressed satisfaction with clarifications made by the Nigeria Governors’ Forum, represented by its Chairman, Governor Kayode Fayemi of Ekiti State. Akande said that the Minister of Finance, Budget and National Planning, Zainab Ahmed, and Emefiele also made clarifications on the issue.

He said: “Having received presentations from the Minister of Finance, the Central Bank Governor, and the NGF, the NEC has affirmed that there was no printing of N60 billion or any other amount whatsoever to shore up allocation for the month of March as wrongly insinuated recently in the press. The Council expressed satisfaction with clarifications made by the NGF, the Finance Minister and the CBN Governor. Both the Minister and the CBN Governor stated to the Council that the allegation of the printing of money to augment allocation was outrightly false. The NGF also supported the conclusion and NEC affirmed same as the highest constitutional body tasked with economic affairs in the country.”

Meanwhile, Emefiele had earlier explained that the apex bank does not just print money and distribute to people. He warned that the apex bank would take immediate steps to recover all N614 billion credit facilities given to states in budget support and bailouts to enable them pay salaries in the past.

He said: “I think it is important for me to put it this way, that in 2015 and 2016, the kind of situation we found ourselves, we did provide a budget support facility to all the states of this country. That loan is still unpaid up till now. Most countries in the world today are confronted not only by the challenges coming from the COVID-19 pandemic, but other issues causing economic crisis. What I keep saying is that it will be irresponsible for the CBN or any other federal reserve bank to stand idle and refuse to support its government at this time.”

Ahmed had also countered Obaseki’s position on the issue. Speaking to newsmen after a Federal Executive Council meeting in Abuja, Ahmed said what was distributed at the monthly FAAC meetings were generated revenue from government institutions available to the public at the ministry’s website. She said: “The issue that was raised by the Edo governor for me is very, very sad, because it is not a fact. What we distribute at FAAC is revenue that is generated and in fact distribution of revenue is a public information. We publish revenue generated by FIRS, the customs and the NNPC and we distribute at FAAC. So, it is not true to say we printed money to distribute at FAAC, it is not true.”

Some analysts believe that Obaseki was probably drawing attention to the undeniable revenue challenge the Nigerian Government presently contends with and the dire need to accelerate economic diversification to accommodate broader revenue options. According to Laoye Jaiyeola, Chief Executive Officer of the Nigeria Economic Summit Group, central banks of other countries facing similar economic challenges as Nigeria also print money. Jaiyeola corroborated Emefiele explanation that “printing money” does not always have to do with physical cash.

He said: “When they say printing money, it is not cash. You know how banks create money; it is not only cash. All the money we have in Nigeria is not in cash. So, the CBN can create N1billion and only about N100million out of it can be in cash.” He urged stakeholders to understand the concept of “ways and means” to get the issue in proper perspective.

Jaiyeola added: “The concept of ways and means is something most of us should understand. If government says this is our budget for the year, these are statements of where they expect income to come from and what expenses they are going to have. But this income does not come at the time they expect it. So, the central banks as governments’ bankers are allowed to give some amount of money to the governments pending when they then pay back. So, the CBN does that through the concept of ways and means. So, when government eventually gets this money, they pay back.”

Shedding more light on the contentious issue, a professor of Economics from the University of Ibadan, Lanre Olaniyan, also said the idea of printing money mainly relates to the CBN creating money for government. Olaniyan said that “creation of money” for government by central banks was normal, adding that cash will only be involved if the cash reserve was extremely low. He explained that the idea was for the central bank to give loans to government as “the lender of last resort”. He added: “In elementary economics, we are told that the central bank is the lender of last resort to the government.”

Olaniyan said “Seigniorage”, the process where the apex bank prints money to fund activities of government, is a welcome development in economics when necessary. He added that a country freshly out of recession, like Nigeria, needed to put money in people’s pockets. “The Federal Government will have to spend enough money that will go round a large percentage of the citizenry to sustain the post-recession economy; it is called quantitative easing,” he said.

However, a breakdown of details of the February revenues, which were shared by the three tiers of government in March listed VAT as contributing a total of N157.327 billion, the largest revenue shared. This was followed by petroleum profit tax of N137.583 billion, and remittances by the Department of Petroleum Resources of a total of N133.583 billion. Nigeria Customs Service contributed N89.350 billion; company income tax and related taxes, N66.356 billion; Nigerian National Petroleum Corporation, N64.161 billion; and Ministry of Mines and Steel Development provided N976 million.

The breakdown shows a gross income of N649.336 billion, but when the cost of revenue collection as well as the 13 per cent derivation payment to oil-producing states were deducted, the total came to N596.944 billion. N8.645 billion was taken from the Forex Equalisation Fund Account to augment the allocations, making it a total of N605.589 that was shared by the three tiers of government.

The document shows that the federal government got N205.160 billion as its share, while the 36 states received N166.085 billion and the 774 councils got N122.853 billion. Oil-producing states shared an additional N37.143 billion as derivation payment. There is no entry to indicate that N60 billion was added from any source.

An economist, Tope Fasua, believes that printing of money is an integral part of the functions of the CBN. Fasua said the apex bank performs that function through the Nigerian Security Printing and Minting Plc, where it is the largest shareholder. He added: “The reason why the CBN will want to print money ranges from the routine to the emergency. Routine because the CBN has to ensure that banks are always liquid in terms of cash, and emergency for the purpose of economic intervention.”

The Chairman of the Progressives Governors Forum, Governor Abubakar Bagudu of Kebbi State, also waded into the controversy. Bugudu explained that due to the shortfall in revenues by N43.34 billion compared to the previous month, an augmentation was made in the sum of N8.65 billion from the Forex Equalisation Fund Account. He said this brought the total distributable revenue to N605.59 billion. He added that revenues distributed monthly primarily consisted of mineral revenues from the sales of oil and gas, as well as non-mineral revenues from customs and excise duties, company income tax and value added tax.

By Kadiri Abdulrahman,

The Eagle